Investing in the share market can be a good way to fight inflation and make some extra money. If you are reading this, it is likely that you have already opened a Demat and Trading account with Sharekhan, done your research, and are prepared to buy shares right away. If not, Read this article to learn about How to start investing in the share market in India.

Sharekhan is one of the top brokers in India and offers hassle-free services. I have been with them since March 2015 and never faced a single problem in buying and selling shares. They offer all the 3 ways to buy and sell shares/stocks-

- Online (through their website)

- Mobile App

- Offline

Buy/Sell shares Online using Sharekhan Website

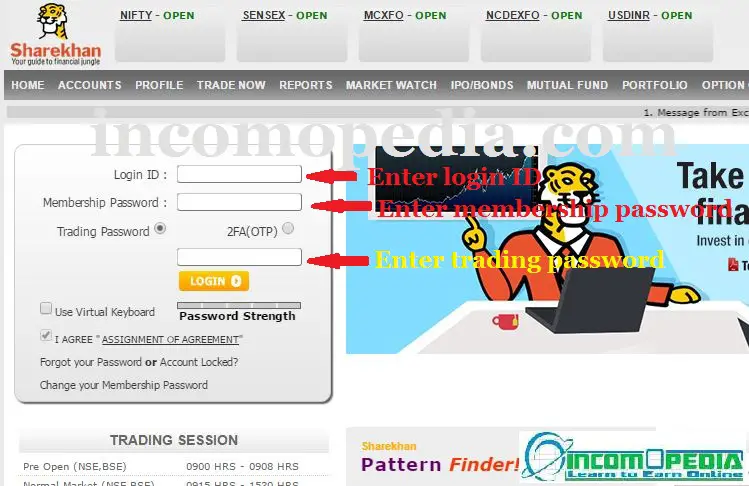

Sharekhan recently revamped its website. To buy/sell shares through their website, you need a computer, an internet connection, and login credentials(Username, Membership password, and Trading password) that Sharekhan sent to you through the mail. Here are steps that one needs to follow in order to execute an order-

- Go to Sharekhan Website

- Click on Trade now, the login page will be opened in a new Tab

- Login using your Username, Membership Password, and Trading Password as shown in the picture below.

- After login, you will be redirected to the Sharekhan dashboard where you can check out your balance, view reports, and stock ideas, manage your portfolio and control many other things. To buy and sell shares, click on Trade Now situated on the Main Menu bar.

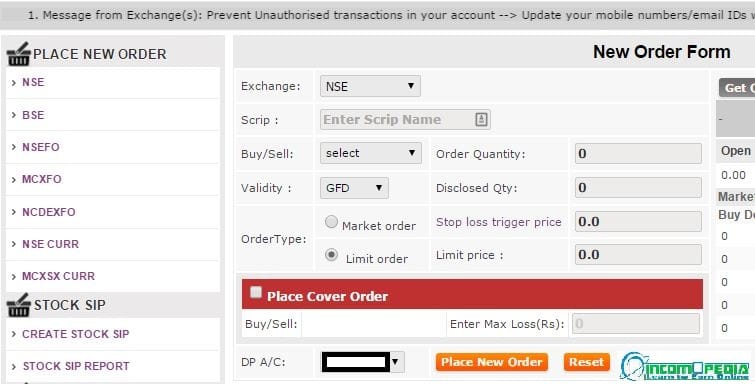

- You will be redirected to a new page where you will see New Order Form that you have to fill in order to buy shares as shown in the picture below. You can see the live performance of shares/stocks on the right side of the order form by entering the name of shares/stock in the order form.

Let’s understand the terminology used in New Order Form-

- Exchange – Select the exchange in which shares/stocks have to be traded. Two major exchanges in India are – NSE(National Stock Exchange) and BSE(Bombay Stock Exchange).

- Scrip – Enter the name of the stock you want to buy. For example – you want to buy the shares of IDEA cellular, then enter the word “Idea” and as soon as you enter the initial few letters of stock, it will show suggestions automatically, so that you can find the right shares/stock you really want to trade. After Entering the scrip name, you can see the live performance of the stock on the right side of the form.

- Buy/Sell – Select what you want to do with the selected stock i.e. Buy or Sell. You also get other options here like Short sell which allows you to sell shares/stocks even if you don’t own them at the time of trading.

- Order Quantity – Enter the quantity of shares/stocks you want to trade such as Enter 10 if you want to buy or sell 10 shares.

- Disclosed Qty – It is optional to enter a disclosed quantity. It should be a minimum of 10 % of the quantity and not more than the order quantity. Enter the quantity in the box that is to be disclosed to the market. This option is used when a trader doesn’t want to let others know How many shares he is buying. Leave this box Empty.

- Validity – Select GFD(Good For Day) here as it will execute the order on the same day on which you place an order. Two other options here are – IOC (Immediate or Cancel) and My GTD(Good till Day), MyGTD allows you to specify the number of days for which you wish to place the orders and IOC sends a request to the broker to execute the order immediately or cancel it. The orders in IOC are executed or canceled according to the availability of matching orders in the market.

- Order type – Select Market Order to buy or sell a stock at the best available price. Usually, this type of order will be executed immediately. Select Limit Order to buy or sell a stock at your own price. To do so, Enter your own price in the Limit Price box, If the price of the stock reaches your target price on the same day of placing the order then the order will be executed otherwise order will be canceled and in that case try your luck on next day. Stop loss trigger price is an advanced trading option. You can leave it empty or set a price but you must know how it works. If you are a busy person and can’t keep your eyes on the market and your portfolio all the time then you can set a price here. For example, if you bought 1 share of XYZ company at a price of 10 rupees and now its price is 20 Rupees but you don’t have time to monitor the progress of the stock then you can set a price between 10 to 20, let’s say you set it 15, then your order will be executed automatically as soon as the price of stock reach at 15 rupees and thus you will not face any loss that could have been happened if the price of the stock had gone even below 15. The stop loss trigger price option can be used in many ways.

Once you have traded the stocks/shares, you can monitor the performance of your stock by clicking on Portfolio on the Main menu bar. Your order may show pending/Partially executed and fully executed depending upon the status of your order.

I have bought some shares but my Demat account is not showing any? No worries. Your account will show the shares after settlement i.e. T+2(Transaction + 2 days).

Buy/Sell shares using Sharekhan Mobile App

You can download the Sharekhan app for both android and iPhone smartphones. Either go to this link and download according to the OS of your mobile or find their app on the Play store by searching the term “sharekhan”. Their app is having a rating of 3.8 out of 5 and is not as good as their website. Certainly, it lakes some important features. This is how to buy/sell shares using the Sharekhan mobile App-

- Open the “Sharemobile ” app on your smartphone

- Log into your account by entering your username, membership password, and trading password.

- You will be redirected to dashboard, Tap Trade as shown in the picture below

You have learned the terminology used in the order form, so it’s pretty easy for you to place an order now. After placing an order you can check and manage your portfolio by going to the app dashboard and tapping on Eq Holdings.

Note: You will have to change one of your passwords (either Membership or Trading Password) after every 14 days.

Buy/Sell shares offline with Sharekhan

Years ago when online trading services were not available, people had to visit brokerage firms with suitcases. Most people now prefer online trading as it has several advantages over offline trading. I personally don’t recommend offline trading because of 3 reasons –

- Offline trading is costlier.

- Less or no transparency in offline trading. You have to do things in broker ways.

- Unwieldy process. You have to fill in details and sign slips and give them to the broker every time.

Still, if you are not comfortable with digital stuff then offline trading is for you. To complete the order, either visit your brokerage firm or call them up and Tell them all the details of your account for verification. Tell them what stocks you want to buy/sell, quantity, limit price, etc and they will place an order for you. You must have funds in your account for completing orders. Sharekhan doesn’t charge you for “Dial and Trade”.

Note: They have revamped their website recently and this is for good. Their website is much faster now and it has really become easy to navigate through different options.

So this was all for this post. Trade wisely. Thanks for reading my post. Share if you find it helpful.

Can you tell me the cons of Sharekhan?

I heard that the website crashes often. Is that true?

Are you still using Sharekhan?

Thanks for your reply Sudhir.

Your blogs are super amazing!!

I still use sharekhan. To be honest, I have never faced a crash while using their website. I could not transferred money from sharekhan account to bank account once. They said they would send me a cheque instead of online transfer. But later this issue was also resolved. Also I am using my sharekhan account since last 2 year without paying any yearly fee. Overall, I would give it a 4 out of 5.

Thanks a lot for your reply!

I am also using Sharekhan now for the past few months. Their services are good.

Also, one final question. Do you feel that the brokerage fee is higher comparatively and do you feel that the company plays with your money without your permission?

I heard these two complaints about them.

Can you write more articles related to stocks. It’s really interesting to read.

I believe a brokerage firm can set up different brokerage fee for different accounts. Talk to your broker directly about it and ask them if they can reduce your brokerage fee. Tell them other brokers are offering you lower fee.

You can also switch your account to discount brokerage firms like ZERODHA(charging 20 INR per trade). Discount brokerage firms charge a flat fee per trade no matter how big or small your trade is.

I am not very good at trading.

Naaiiiiiiiiicc,thanks for the detailed explanation which at the same time is easy-to -understand for a novice in the world of stock trading.😊

I m using sharekhan so many times but I am not satisfy from there services.

Thankyou so much for the most intrinsic information i m looking from so long.

I would like to hold my equities as long as i can, sooo which option i need to use when i buy the shares??

Place a normal order and you can hold your shares as long as you want. Open order form >> select exchange(NSE or BSE) >> Enter scrip name >> select buy >> select validity as “GFD” >> Order type – Market >> Fill order quantity and click on place new order. That’s it.

Hi,

in Sharekhan, How will I place Stop Loss order for myGTD type? For example, I bought a share at 100. Now I want to place a sell order which is valid till the date I have given using myGTD for a price of 95 to limit my loss exposure. I tried several ways but keeps getting rejected for my orders. I want sell the share at market once the price reaches 95 no matter the price. Do let me know how to do this? Also how you use trailing stop loss for the same type. Thanks

How to place intraday order in Sharekhan and how it works can you please explain.

If I want share for 3months what options we select gtd, Gfd, ioc

GFD

If I purchased share for 2 months option Gfd, my gtd,, ioc

CAN SOME ONE EXPLAIN HOW CAN I DO INTRADAY TRADE IN THIS APP

I mailed them regarding your query. here is the reply I got – We wish to inform you that in case of BIG TRADE , your open positions are auto squared off by 3.30pm in case you don’t square off the open position by 3.15 pm.

For further information on BIG TRADE facility, you may refer to the BIG TRADE terms and conditions for on the TRADE NOW page after logging in to the Sharekahn website and selecting the scrip.

Also, we wish to inform you that in case of a normal BUY and SELL, auto square off of position is not done and you may square off same to do an intra day trade. Request you to kindly take a note of same.

Their support email is – myaccount@sharekhan.com

i try to sell some company shares without buying it but its showing me “saleable quantity is less than order quantity” i tried many ways like order, bracket order, bracket + trailing order in sharekhan.

some one can make me understood it?

Saleable quantity is the amount available for sale. You are trying to sell something which you don’t own.

Hi….which option in sharekhan I need to choose if I want to buy shares and want to hold them for a long time for example for few months ..

Place a normal order and you can hold your shares as long as you want. Open order form >> select exchange(NSE or BSE) >> Enter scrip name >> select buy >> select validity as “GFD” >> Order type – Market >> Fill order quantity and click on place new order. That’s it.

Is big trade for intraday or delivery orders?

Where I can see my net balance and trading balance in sharekhan app.

i have already invested 75000 in market thru sharkhan dP. but not much cash balance in the Trading account. suppose i want to buy some shares at lowest rate. how to place an Buy order using my portfolio. Say cash balance is 800 only. i want buy 140*100 ashok leyland. how to do that please explain

Hi

How a transaction execute in sharekhan?

Sir,I need some clarification.Hope u ll help me out.

1.Can I buy and sell shares in shrekhan in the same day using normal buy and sell?

2.For positional and swing trading,How can i buy shares with selling price and stop loss.sir,I Mean to ask shall I use normal buy order + bracket order for positional trades?

Thank u in advance